TDS & TCS Rates for FY 2025-26 Key Budget Updates You Need to Know

1. Rationalization of TDS Rates and Thresholds (A) Reduction in TDS Rates for Section 194LBC (B) Increase in TDS Thresholds for Various Payments In addition to the changes to TDS/TCS rates, the budget proposals also aim to rationalize various TDS provisions by adjusting the thresholds beyond which tax must be deducted. Below is the detailed […]

2025 Customs Duty Update: Key Increases, Decreases, and Their Impact on Various Sectors

The Customs Tariff Act, 1975 is undergoing significant changes in its duty rate schedule. With the Finance Bill, 2025 introducing amendments that will come into effect from February and May 2025, businesses across various sectors must understand how these changes affect import and export duties. In this post, we break down the amendments sector‑wise, covering […]

GST Return Filing – JULY 2024 to January 25 GST UPDATES

Introduction to GST Return Filing Updates From July 2024 to January 2025, significant updates have impacted the GST return filing process. These updates focus on new deadlines, amended forms, and added features that simplify the filing process. Businesses need to be aware of these changes to stay compliant and avoid penalties. Key Changes in GST […]

GST Recent Amendments – July 2024 to January 2025 Updates

Introduction: Staying updated with GST changes is essential for businesses. The amendments introduced between July 2024 and January 2025 bring significant updates. These modifications impact compliance procedures, tax rates, and industry-specific regulations. By understanding these changes, businesses can remain compliant and avoid penalties. Key Changes and Updates Sr. No Blogs 1 New ISD Registration Requirement […]

GST ITC – Key Updates from July 2024 to January 2025

GST compliance has changed significantly in recent months. The introduction of the Invoice Management System (IMS), revised ITC rules, and improved transparency tools are key updates. These changes simplify tax reporting, reduce mismatches, and enhance accuracy. Sr. No Blogs 1 RCM Liability/ITC Statement: A New Transparency Tool on the GST Portal 2 Understanding the Invoice […]

GST Refund Updates – July 2024 to January 2025

Overview: The period between July 2024 and January 2025 has seen several key updates and clarifications regarding GST refunds, especially for exporters. These changes are designed to streamline processes, reduce compliance burdens, and ensure quicker refunds. In this blog, we will cover all the important GST refund-related developments during this period, along with guidelines for […]

Union Budget 2025 Expectations: A Comprehensive Analysis

As the 2025-26 financial year approaches, Finance Minister Nirmala Sitharaman faces the task of addressing pressing economic challenges while steering India toward sustainable growth. With multiple sectors sharing their expectations, this budget has the potential to reshape the country’s economic trajectory. Below is a sector-wise overview of the primary expectations from the Union Budget 2025. […]

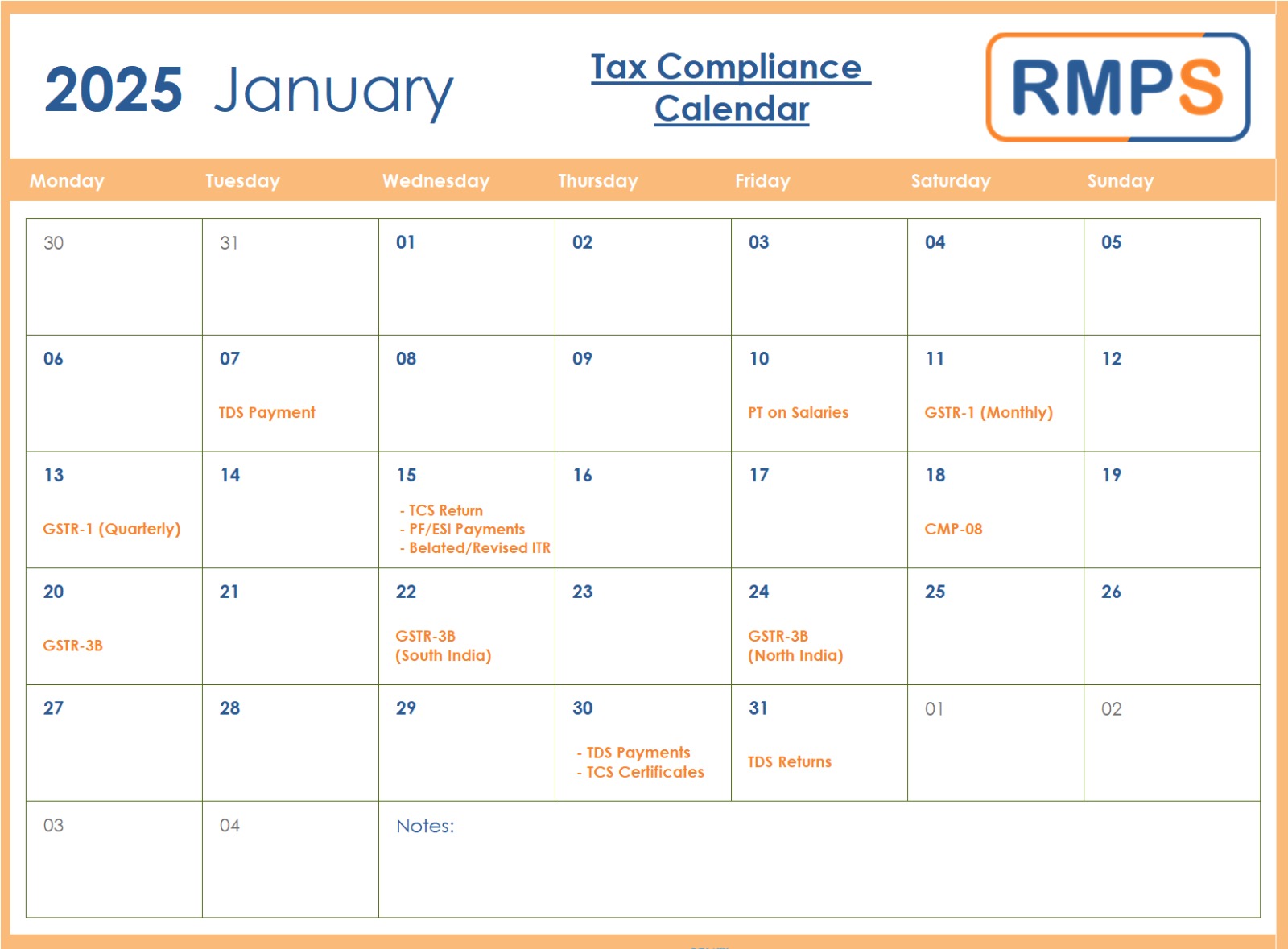

January 2025 Compliance Deadlines: Key Dates and Requirements

As the new year begins, staying on top of compliance deadlines is crucial for businesses and individuals to avoid penalties. January 2025 brings a host of important dates for tax filings, payments, and returns. Here’s a clear, concise guide to help you stay compliant. Key Compliance Deadlines in January 2025 7th January: TDS Payment for […]

55th GST Council Meeting: Key Agendas and Expectations

The 55th GST Council Meeting is scheduled for December 21st, 2024, in the historic city of Jaisalmer, Rajasthan. As a highly anticipated event, this meeting is set to address critical issues in India’s Goods and Services Tax (GST) framework, aiming to foster economic growth and improve tax compliance. Let’s explore the agenda and potential implications […]

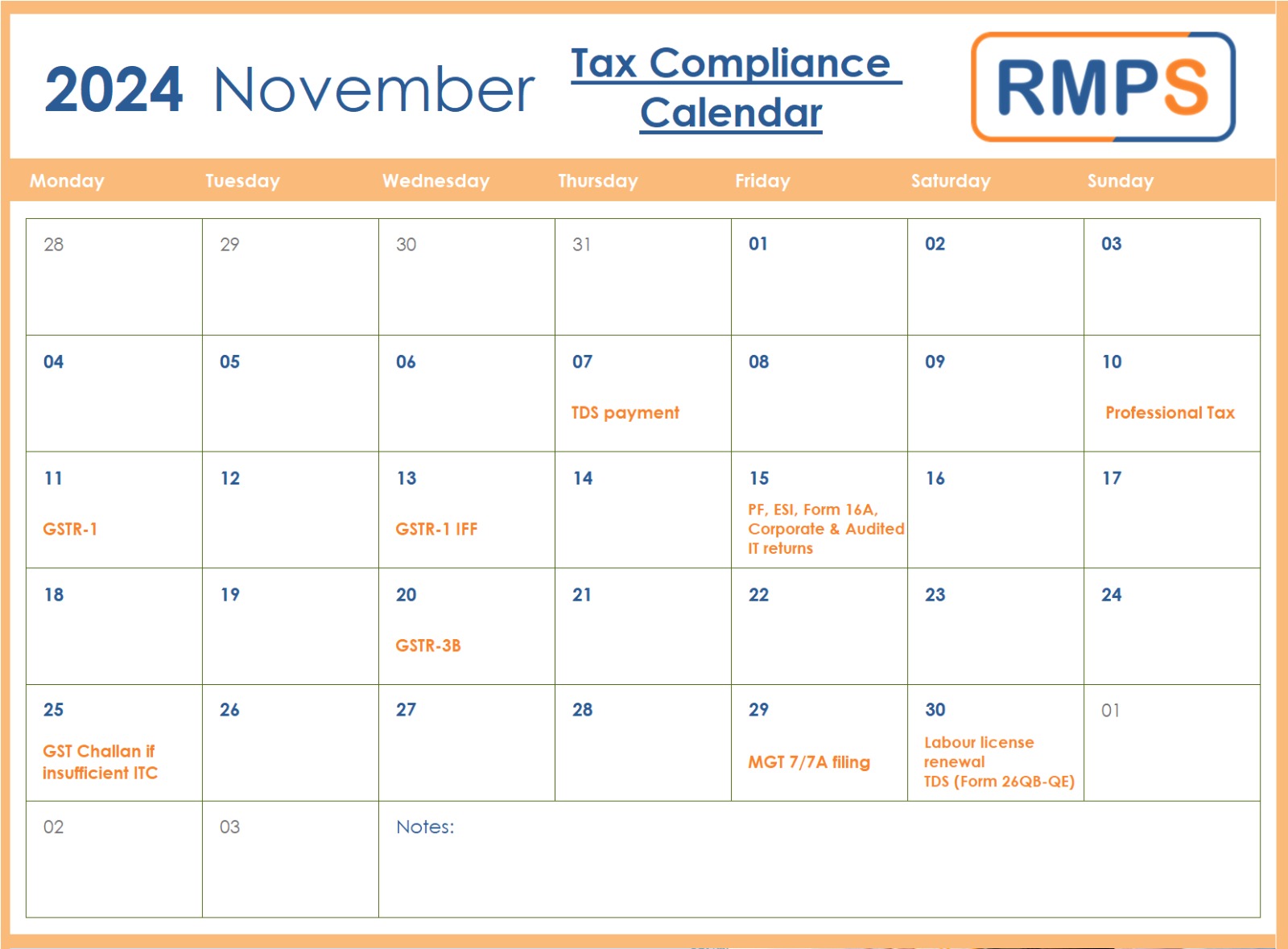

Essential Tax and Compliance Deadlines in November 2024: A Quick Guide for Businesses

November is a significant month for businesses, with multiple tax and regulatory deadlines. Meeting these deadlines is essential to avoid penalties, maintain compliance, and ensure seamless business operations. Here’s a quick rundown of what to keep in mind for November 2024. 1. TDS Payment (Due by November 7th) Businesses need to deposit the Tax Deducted […]