Enabling Filing of Application for Rectification Under Notification No. 22/2024-CT

The Central Government, based on recommendations from the 54th GST Council, has introduced a new facility under Notification No. 22/2024-CT dated October 8, 2024. This notification allows registered taxpayers to rectify demands related to incorrect Input Tax Credit (ITC) claims that were previously issued due to non-compliance with sub-section (4) of section 16 of the […]

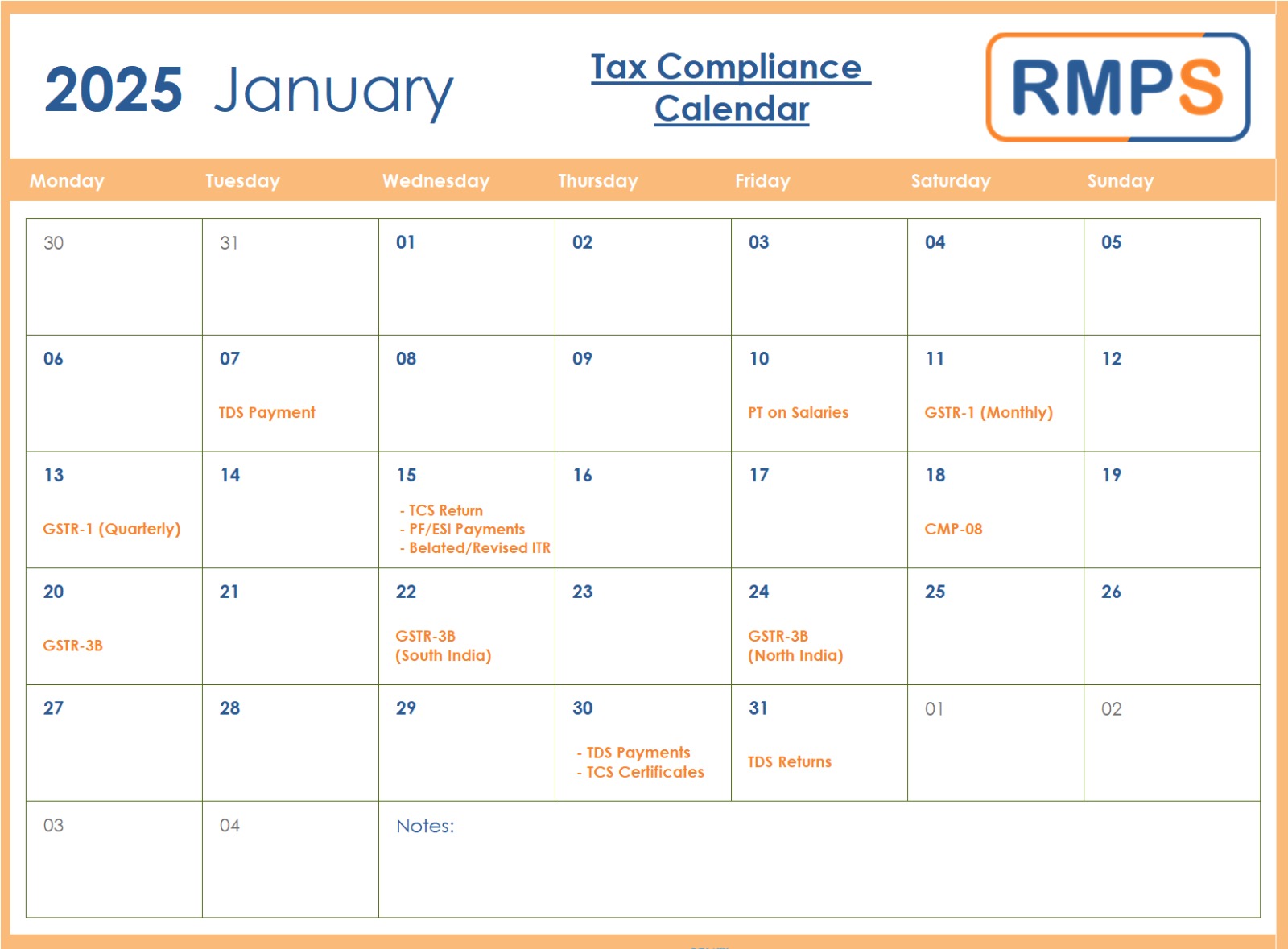

January 2025 Compliance Deadlines: Key Dates and Requirements

As the new year begins, staying on top of compliance deadlines is crucial for businesses and individuals to avoid penalties. January 2025 brings a host of important dates for tax filings, payments, and returns. Here’s a clear, concise guide to help you stay compliant. Key Compliance Deadlines in January 2025 7th January: TDS Payment for […]

Advisory for Waiver Scheme under Section 128A

The GST Network (GSTN) has issued an important advisory concerning the Waiver Scheme under Section 128A. Taxpayers are strongly advised to review the details and follow the necessary steps to avail of the benefits offered under this scheme. Key Highlights of the Advisory 1. Reference to the Advisory Issued by GSTN GSTN released an advisory […]

GST Rate Changes and Clarifications: Highlights from the 55th Council Meeting

Introduction The 55th GST Council Meeting introduced significant changes, including GST rate revisions, clarifications on taxability, and measures to simplify compliance. From updates on used vehicle taxes to exemptions for agricultural goods and improved trade facilitation, these changes aim to streamline the GST framework and resolve key ambiguities for businesses and taxpayers. Key Updates to […]

Everything You Need to Know About the 55th GST Council Meeting

The 55th GST Council meeting, held on December 21, 2024, in Jaisalmer, Rajasthan, introduced several important updates. Union Finance Minister Smt. Nirmala Sitharaman led the session, accompanied by state finance ministers and senior officials. Together, they focused on making GST compliance easier, revising tax rates, and resolving ambiguities. Let’s dive into the significant decisions made […]

Maharashtra Govt Forgives INR 27,000 Crore Under GST Amnesty Scheme

The Maharashtra Government has introduced an Amnesty Scheme under the Goods and Services Tax (GST) regime, waiving INR 27,000 crore in penalties and interest for liabilities accrued between FY 2017 and 2020. Announced by Deputy Chief Minister Ajit Pawar in the state legislature, the scheme allows businesses and taxpayers to settle their dues without additional […]

Enhancing GST Compliance: Key Updates to the E-Way Bill and E-Invoice Systems

As part of its ongoing commitment to improving digital compliance, the GST Network (GSTN) has announced critical updates to the E-Way Bill and E-Invoice systems, effective from January 1, 2025. These updates focus on enhancing security, streamlining operations, and ensuring compliance with government standards. Here’s a breakdown of the major changes taxpayers need to know: […]

Complete Guide to GSTR9: Applicability, Categories, Structure, and Filing Process

The GSTR9 annual return is an essential compliance requirement under India’s GST system. It serves as a consolidated summary of the year’s GST activities for taxpayers, including outward and inward supplies, taxes paid, input tax credits (ITC) claimed, and any reconciliation required. This blog simplifies everything you need to know about GSTR 9: its applicability, […]

55th GST Council Meeting: Key Agendas and Expectations

The 55th GST Council Meeting is scheduled for December 21st, 2024, in the historic city of Jaisalmer, Rajasthan. As a highly anticipated event, this meeting is set to address critical issues in India’s Goods and Services Tax (GST) framework, aiming to foster economic growth and improve tax compliance. Let’s explore the agenda and potential implications […]

The Ultimate Guide to Fully Electronic GST Refund Process in India

The introduction of the Goods and Services Tax (GST) brought significant changes to India’s tax structure. To ease the burden of tax compliance, the Central Board of Indirect Taxes and Customs (CBIC) introduced a fully electronic GST refund process via FORM GST RFD-01. This streamlined process offers businesses greater efficiency and transparency. Here’s an in-depth […]