Changes and Compliances in GSTR 9 & 9C for FY 2023-24

Introduction The evolving landscape of GST regulations, combined with departmental audits, has significantly impacted the process of filing annual returns. This article provides a comprehensive overview of the changes in Form GSTR 9 and GSTR 9C for FY 2023-24, along with reconciliations, best practices, and solutions to advanced issues. Key Dates Reconciliations to Perform Essential […]

Understanding the Difference Between Table 8A and 8C in GSTR-9 for FY 2023-24

The Goods and Services Tax (GST) system is always evolving, and taxpayers need to stay updated. For FY 2023-24, changes in the way Input Tax Credit (ITC) is reported in Table 8A and Table 8C of GSTR-9 have caused confusion for many businesses. This guide explains these changes and offers practical solutions to common issues. […]

Real Estate – Understanding RCM Provisions

The new GST scheme requires builders and developers, referred to as promoters, to procure at least 80% of their inputs and input services from registered suppliers (RPs). If this threshold is not met, promoters must pay GST on the shortfall under RCM at 18%. Importantly, this calculation applies project-wise rather than entity-wide. Key Notifications and […]

Comprehensive GST Updates: April to November 2024

The period from April to November 2024 brought several important updates in India’s Goods and Services Tax (GST) framework. This blog consolidates major GST circulars, policy updates, system enhancements, compliance requirements, and economic indicators, ensuring businesses and taxpayers stay informed about the evolving tax landscape. GST Circulars and Notifications (April to November 2024) July 2024 […]

A Comprehensive Guide to E-Invoicing and Tax compliance

E-invoicing has revolutionized the way businesses handle invoicing and tax compliance. This blog explains what e-invoicing is, how it works, and why it is beneficial for businesses in India. What is E-Invoicing? E-invoicing is a digital system where businesses report their invoices to an Invoice Registration Portal (IRP) for validation under GST rules. After uploading […]

Comprehensive Checklist for Accountants During GSTR-9 and 9C Filing

As the financial year concludes, the responsibility of ensuring accurate GST compliance intensifies. Filing the GST annual return (GSTR-9) and reconciliation statement (GSTR-9C) are crucial for maintaining transparency and avoiding penalties. This blog provides a comprehensive checklist for accountants to ensure seamless GST compliance, especially when filing GSTR-9 and GSTR-9C. Understanding GSTR-9 and GSTR-9C Before […]

RCM Time of Supply Rule Changes Effective from November 1, 2024: What Businesses Need to Know

The Central Board of Indirect Taxes and Customs (CBIC) has introduced critical updates to the Reverse Charge Mechanism (RCM) under the Goods and Services Tax (GST), effective from November 1, 2024. These changes aim to enhance compliance, streamline self-invoicing, and ensure accurate input tax credit (ITC) claims. Here’s a detailed breakdown of the updates and […]

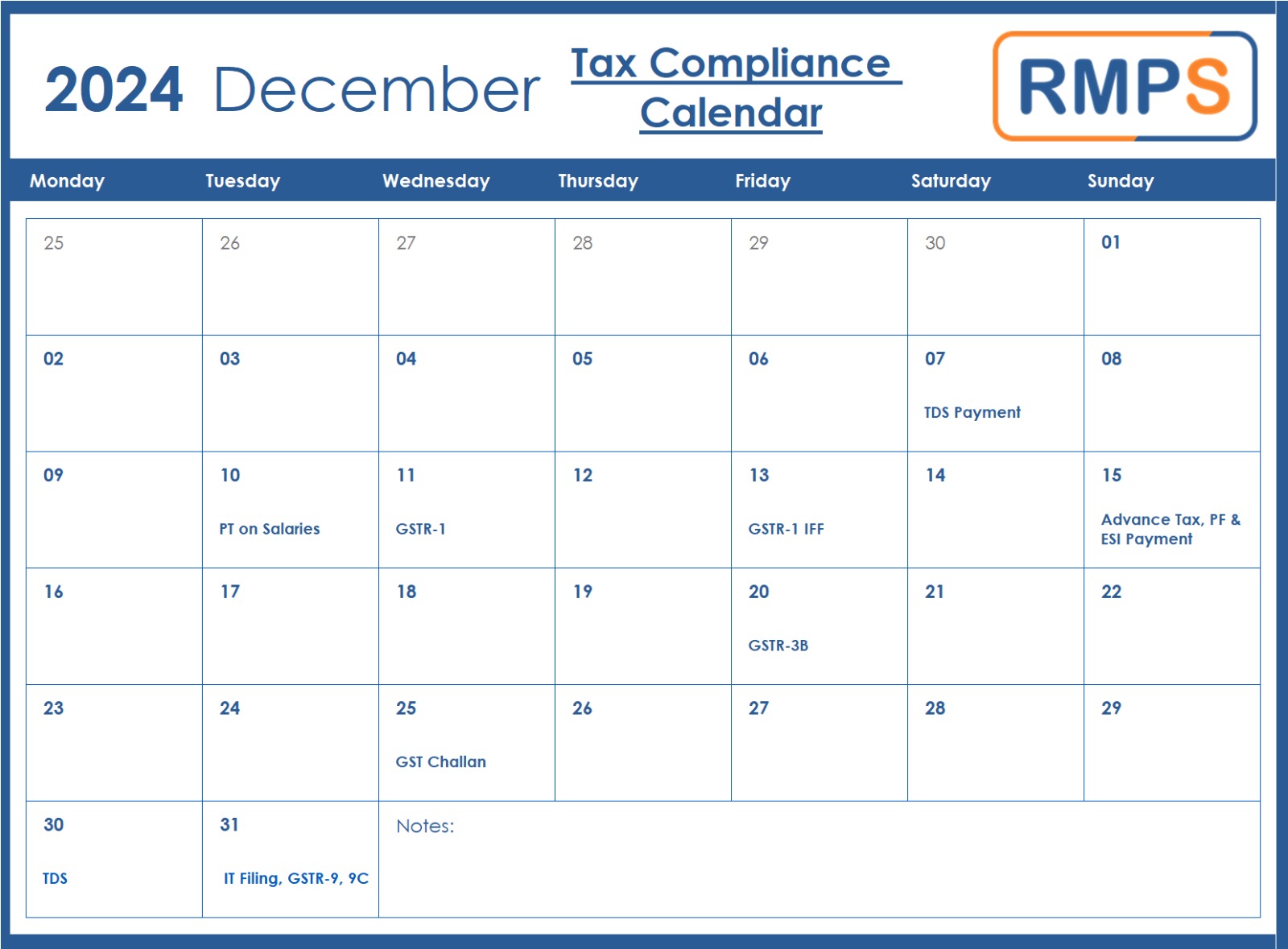

December 2024 Tax Compliance Calendar: Deadlines You Can’t Miss

Managing tax compliance is essential for businesses. Missing key deadlines can lead to penalties, which can be avoided by careful planning. The December 2024 Tax Compliance Calendar outlines important dates for tax filings, payments, and submissions. Let’s explore the key deadlines and how you can meet them effectively. Important Tax Deadlines in December 2024 December […]

Advisory for Reporting TDS Deducted by Scrap Dealers in October 2024

Effective October 10, 2024, as per Notification No. 25/2024-Central Tax, all registered persons receiving supplies of metal scrap (classified under Chapters 72 to 81 of the Customs Tariff Act, 1975) from other registered persons must deduct Tax Deducted at Source (TDS) under Section 51 of the CGST Act, 2017. Issue: Reporting TDS Deducted in October […]

Free Diesel and GST: Clarity from the Uttarakhand High Court

The Uttarakhand High Court recently addressed an important issue under GST. It ruled that free diesel provided by the recipient should not be added to the value of Goods Transport Agency (GTA) services for GST purposes. This decision, given in the case New Jai Hind Transport Service v. Union of India on September 27, 2024, […]