Facility of enrolment for supply of goods through e-commerce operators by GST un-registered suppliers.

1.In terms of the recent amendments to the Act and the rules and notification number 34/2023 dated 31.07.2023, persons supplying goods through e-commerce operators shall be exempt from mandatory registration under the CGST Act even if they supply goods through e-commerce operators (ECO) if they satisfy the following conditions: (a)such person is engaged in the […]

Facility for the e- commerce operators through whom unregistered suppliers of goods can supply goods

GSTN has also provided APIs for ECOs (through whom unregistered persons can supply goods) to integrate with GSTN to obtain the details and facilitate the unregistered suppliers. The APIs are for validating the demographic details of the said suppliers and also for use in tracking and reporting supplies by such persons. The details of the […]

“GST Updates: Reversing ITC When Suppliers Miss the September 30th Deadline”

Summary: Rule 37A is applicable if for a particular Invoice/Debit Note, Supplier has duly filed GSTR-1 (along with details of such invoice/debit note) but not its GSTR-3B for that period. Also, Buyer has availed credit based upon its GSTR-2B (auto populated from such GSTR-1 filed by the Supplier). Heading Reversal of Credit (Required or Not) […]

Refunds Under GST

Allowable Refunds 1. Refund of unutilized input tax credit (ITC) on account of exports without payment of tax. 2. Refund of tax paid on export of services with payment of tax; 3. Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax. 4. Refund of tax paid on […]

TDS Rate Chart For FY 2023-24 (AY 2024-25) with TDS Section List

Staying compliant with TDS regulations is crucial for businesses as non-deduction, wrong deduction and even deduction under wrong TDS section could attract huge penalties. It’s important that businesses know the applicable rate, TDS section and exempt limit for each nature of payment. Note: Here is the latest income tax slab for AY 2023-24 (FY 2022-23) […]

Job Work Under GST

What is Job-Work Under GST? The definition of Job-work under GST is covered under section 2(68) of the CGST Act, 2017 states “Any treatment or process undertaken by a person on goods belonging to another registered person”. Therefore, a job worker is a person (registered or unregistered) who is processing or treating the goods of […]

2-Factor Authentication For All Taxpayers With AATO Above Rs 20 Cr Is Mandatory From November 01, 2023

Two Factor Authentication for e-Way Bill & e-Invoice The National Informatics Centre (NIC) has announced that 2-factor authentication (2FA) will be made mandatory for all taxpayers with an Aggregate Annual Turnover (AATO) above Rs. 100 crore from July 15, 2023. This is being done to enhance the security of the e-Way Bill/e-Invoice System and to […]

30 Days Of IRN Reporting Effective From 1 November 2023

In a significant development for businesses in India, the Goods and Services Tax (GST) Authority has introduced a new reporting deadline for e-invoices. Effective from 1st November 2023, this regulation mandates that taxpayers with an Aggregate Annual Turnover (AATO) greater than or equal to 100 crores have a 30-day window to report invoices from the […]

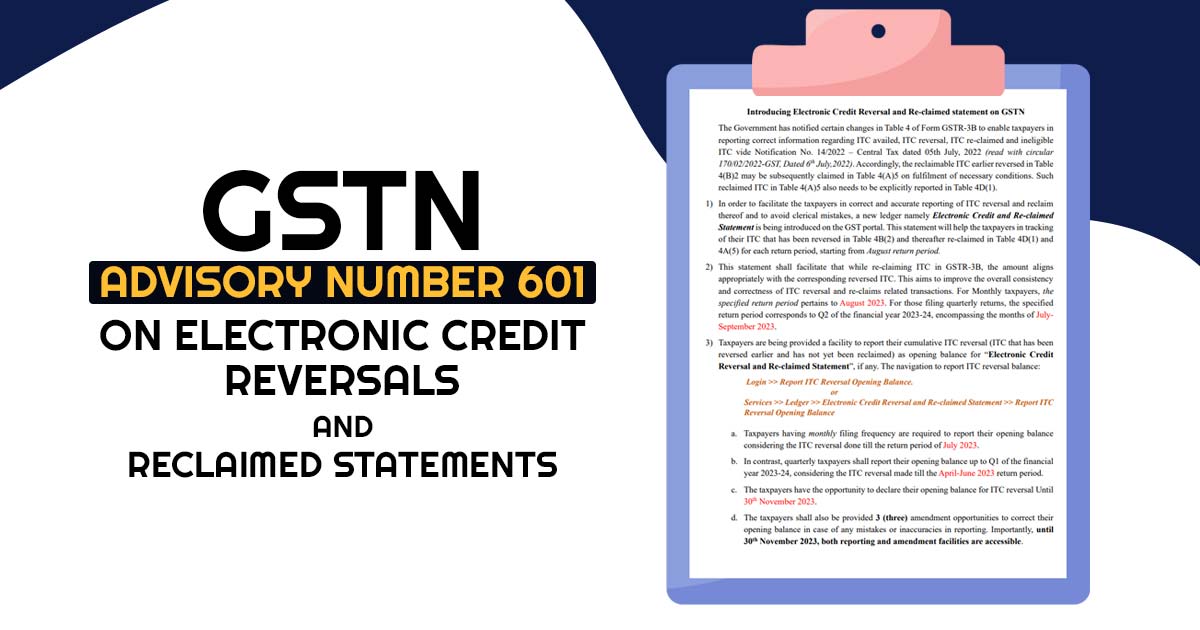

Maximize Your ITC Tracking Efficiency with GSTN’s New Electronic Credit Reversal and Re-claimed Statements!

You can Refer the below link for detail blog : https://www.rmpsco.com/maximize-your-itc-tracking-efficiency-with-gstns-new-electronic-credit-reversal-and-re-claimed-statements/ This Vlog is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event RMPS & Co. or the Author or any other persons be liable for […]

Maximize Your ITC Tracking Efficiency with GSTN’s New Electronic Credit Reversal and Re-claimed Statements!

A new feature called Electronic Credit Reversal and Re-claimed Statements on the GSTN portal has been introduced. This statement is here to help you keep track of your ITC, from reversing it (Table 4B(2)) to reclaiming it (Table 4D(1) and 4A(5)). It covers each return period, starting from the August 2023 return period. Correct Reporting, […]