GST : Summary of recent notifications and circulars.

CBIC issued Notifications and Circulars to give effect to recommendation of the 50th GST Council Meeting. It includes extensions in amnesty schemes for GSTR-10 non-filers, GSTR-9 non-filers, deemed withdrawal of assessment orders, and revocation of registration. Also circulars provide clarification on topics such as Input Tax Credit (ITC) for common input services, holding of shares […]

KEY HIGHLIGHTS OF 50TH GST COUNCIL MEETING

The 50th meeting of the GST Council witnessed the release of a short video film titled ‘GST Council- 50 steps towards a journey,’ highlighting the Council’s progress. The film, available in Hindi, English, and regional languages, will be shared on various social media platforms. Additionally, the Council recommended changes in GST tax rates, trade facilitation […]

Council To Decide On New GST Rule: May have to explain discrepancy in ITC Claims

The GST Council is likely to decide on a new rule in GST law under which businesses would be required to explain the reasons for excess input tax credit (ITC) claimed or deposit the amount with the exchequer, sources said. They said the Law Committee, comprising tax officers from Centre and states, has opined that […]

Addition of Goods and Services Tax Network (GSTN) under Prevention of Money-laundering Act

The scope of the PML Act to include GSTN through Notification F. No. P.12011/2/2009-ES Cell-DOR, has expanded. By bringing GSTN within the ambit of the PML Act, the government seeks to strengthen the existing framework for combating money laundering and illicit activities related to GST. The inclusion of GSTN enables the ED, a specialized financial […]

Geocoding Functionality Now Live for All States and Union Territories

GSTN is pleased to inform that the functionality for geocoding the principal place of business address is now live for all States and Union territories. This feature, which converts an address or description of a location into geographic coordinates, has been introduced to ensure the accuracy of address details in GSTN records and streamline the […]

CGST Delhi West Commissionerate busts nexus of more than 30 fake firms and arrests a person in special drive against fake registrations

The CGST Delhi West Commissionerate under CGST Delhi Zone, upon analysis of an entity under investigation as part of Special Drive against fake registrations, found multiple entities registered on the same address wherein the said address was found existent during verification but the owner of the said premises denied any knowledge about existence of any […]

Online Compliance Pertaining to Liability / Difference Appearing in R1 – R3B (DRC-01B)

GSTN has developed a functionality to enable the taxpayer to explain the difference in GSTR-1 & 3B return online as directed by the GST Council. This feature is now live on the GST portal. The functionality compares the liability declared in GSTR-1/IFF with the liability paid in GSTR-3B/3BQ for each return period. If the declared […]

GST Registration Guidelines: Strengthening the process of verification of applications

Introduction: To address problem of fake registration and fake input tax credit action on a mission mode by Central and State tax authorities in the form of a Special All-India Drive against fake registrations. In this context, it is further felt that verification of applications for registration by the proper officers is one of the […]

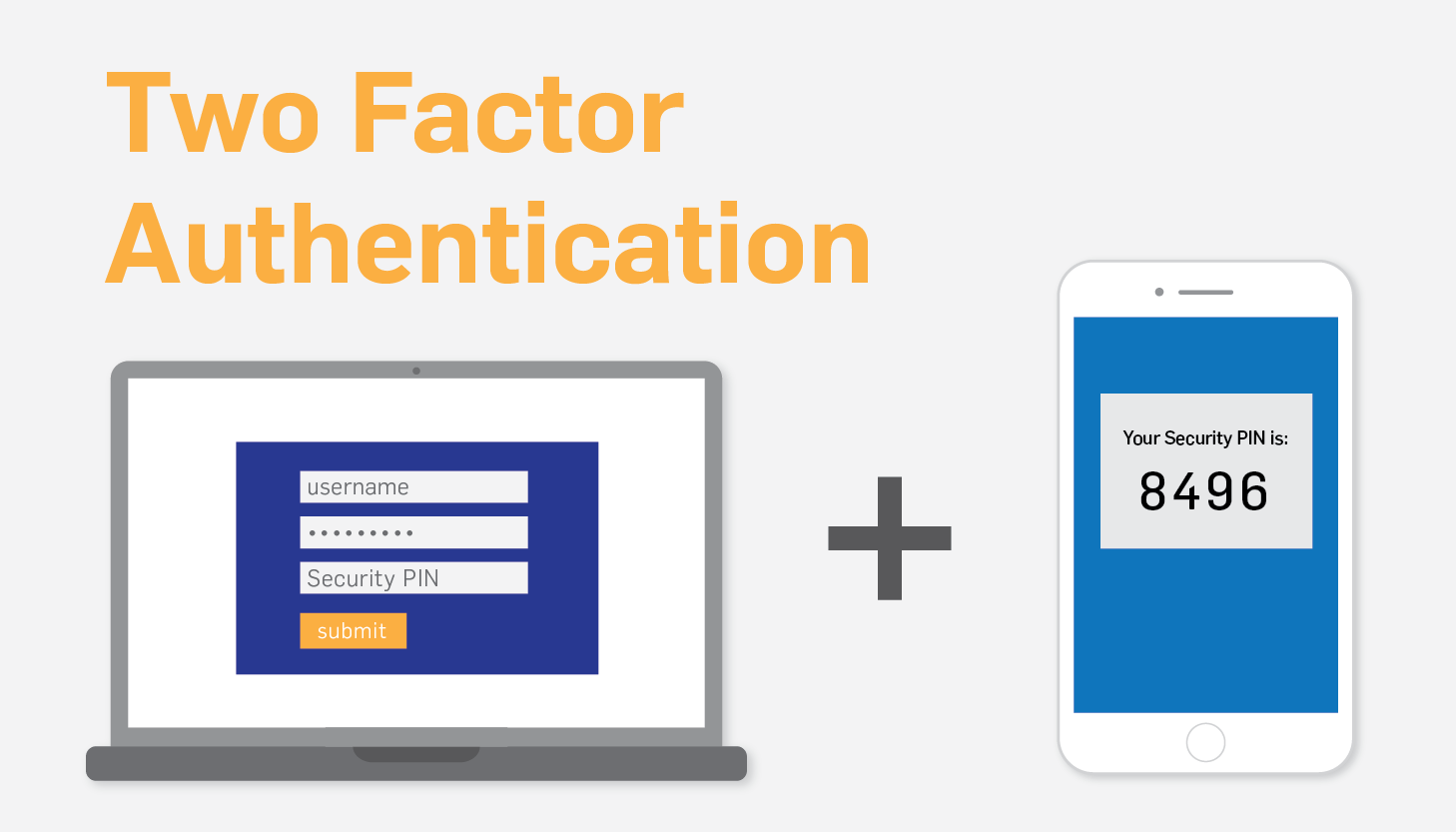

2- Factor Authentication for e-Way Bill and e-Invoice System

To enhance the security of e-Way Bill/e-Invoice System, NIC is introducing 2- Factor Authentication for logging in to e-Way Bill/e-Invoice system. In addition to username and password, OTP will also be authenticated for login.There are 3 different ways of receiving the OTP. You may enter any of the OTP and login to system. The various […]

Entitled to take ITC on Work Contract Services availed for construction Services

The Hon’ble Tripura High Court in M/s. SR Constructions v. The Union of India and Ors. held that the assesses is entitled to take Input Tax Credit (“ITC”) on taxable work contract services availed for the supply of construction of an immovable property. SUMMARY OF CASE LAW RELEVANT PROVISION FOR THE CASE Section 17(5)(c) of the […]