Important Advisory on GSTR-2B and IMS

The GST portal has addressed concerns regarding the non-generation of GSTR-2B for October 2024. To ensure compliance and seamless tax filing, it’s essential to understand the key points of this advisory. Key Scenarios for GSTR-2B Non-Generation 1.QRMP Scheme Taxpayers (Quarterly Filers):Taxpayers who file quarterly returns under the QRMP scheme will not receive GSTR-2B for the […]

IMS Implementation Made Smooth Early-Phase Advisory and Supplier Best Practices

Introduction to IMS The Invoice Management System (IMS) on the GST portal helps users manage invoices saved or filed in GSTR-1/1A/IFF, streamlining the process of claiming accurate Input Tax Credit (ITC). How to Access IMS To access IMS, log in to the GST portal and navigate to Dashboard > Services > Returns > Invoice Management […]

Major GST Updates: Key GST Changes Effective from November 1, 2024

On November 1, 2024, significant changes to the Indian GST system took effect. These updates focus on simplifying tax compliance, increasing transparency, and providing relief to taxpayers. Here’s a breakdown of the key changes that can help businesses stay compliant and avoid penalties. Overview of Key GST Changes for Businesses The government’s recent GST updates […]

New Three-Year Limit for GST Returns Filing: What You Need to Know

Introduction The Finance Act, 2023, has introduced a new rule that limits the time taxpayers have to file their GST returns. Starting from October 1, 2023, taxpayers must file their returns within three years from the due date. This blog will explain this change, its impact, and the steps you should take to stay compliant. […]

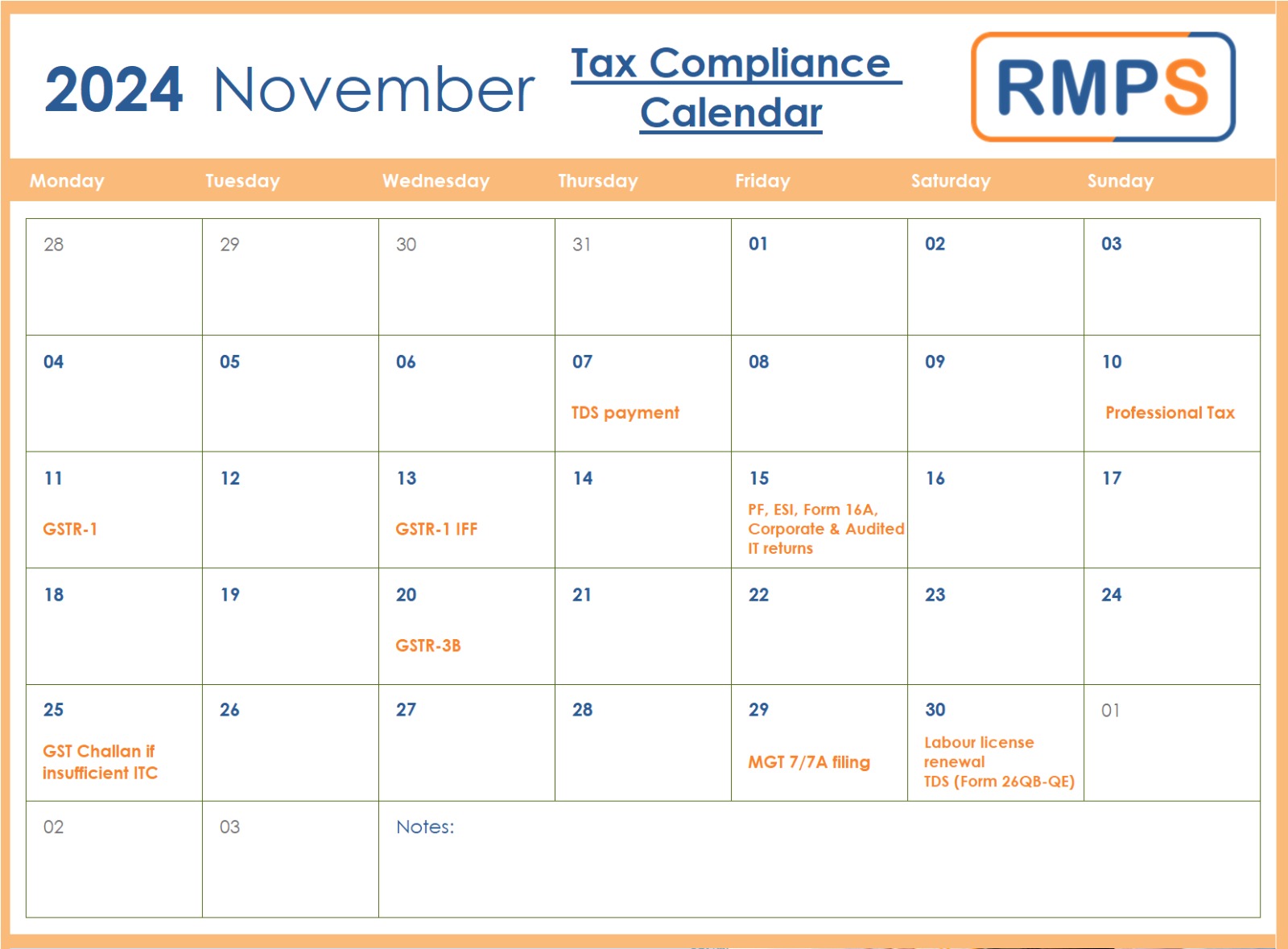

Essential Tax and Compliance Deadlines in November 2024: A Quick Guide for Businesses

November is a significant month for businesses, with multiple tax and regulatory deadlines. Meeting these deadlines is essential to avoid penalties, maintain compliance, and ensure seamless business operations. Here’s a quick rundown of what to keep in mind for November 2024. 1. TDS Payment (Due by November 7th) Businesses need to deposit the Tax Deducted […]

Advisory on Waiver Scheme Under Section 128A of the CGST Act

The GST Council’s recent decision to waive interest and penalties under Section 128A of the CGST Act, 2017, offers welcome relief for many taxpayers. Announced at the Council’s 53rd meeting on June 22, 2024, the waiver applies to cases where no fraud is involved, helping reduce tax disputes and simplifying compliance. Key Points About the […]

Form GST DRC-03A: A Guide for Taxpayers to Ensure Accurate Payment Adjustment

The Goods and Services Tax (GST) system recently introduced Form GST DRC-03A to help taxpayers link their demand payments accurately to outstanding demand orders. This update addresses issues where payments made via Form GST DRC-03 do not close the demand in the electronic liability register. This blog provides a step-by-step guide to using Form DRC-03A, […]

The New Locking Feature for Auto-Populated Liability in GSTR-3B Benefits and Challenges.

The Goods and Services Tax Network (GSTN) issued an advisory on October 17, 2024, regarding the hard locking of auto-populated values in GSTR-3B. This new step aims to reduce human errors and improve accuracy in GST return filings. What is Form GSTR-3B? Form GSTR-3B is a simplified summary return. Taxpayers use this form to report […]

Understanding the Waiver of Interest and Penalty under Section 128A of the CGST Act

On October 15, 2024, the Indian government introduced Circular No. 238/32/2024-GST. This circular explains Section 128A of the CGST Act, 2017, which aims to help businesses reduce their tax burden. By using this waiver, businesses can avoid penalties and interest charges on specific tax demands. However, to take full advantage, businesses must meet certain conditions […]

Understanding the New Changes in Invoice Management System (IMS) for GSTR-2B: FAQs and Guidance

In October 2024, the GST Network (GSTN) introduced the Invoice Management System (IMS) to make tax filing easier. This platform helps taxpayers manage invoices, credit notes, and debit notes for GSTR-2B returns. Many businesses want to know how these changes affect their filing. Below, we answer common questions to help you understand the new system. […]