The Delhi High Court’s Verdict on GST Registration Cancellation: A Landmark Decision

Introduction In a significant ruling, the Delhi High Court set aside the retrospective cancellation of GST registration for JSD Traders LLP. The case, W.P.(C) 2608/2025, challenged the arbitrary cancellation of GST registration dating back to 2017. It raised crucial questions about procedural fairness and legal compliance under the Central Goods and Services Tax Act, 2017 […]

Small Business? Simplify GST with Composition Levy – Deadline March 31

The Goods and Services Tax (GST) framework provides a Composition Levy scheme for eligible taxpayers seeking a simplified tax compliance process. This guide outlines the key details, eligibility, and process for opting for Composition Levy under GST for the financial year 2025-26. What is the Composition Levy under GST? The Composition Levy is a simplified […]

Advisory: Biometric Authentication Now Available for Directors in Home State

Introduction In a significant move towards streamlining the GST registration process, GSTN has introduced an enhancement in Biometric Authentication functionality. This update allows certain Promoters/Directors to complete Biometric Authentication at any GST Suvidha Kendra (GSK) within their Home State, rather than being restricted to their jurisdictional GSK. This initiative aims to improve convenience and reduce […]

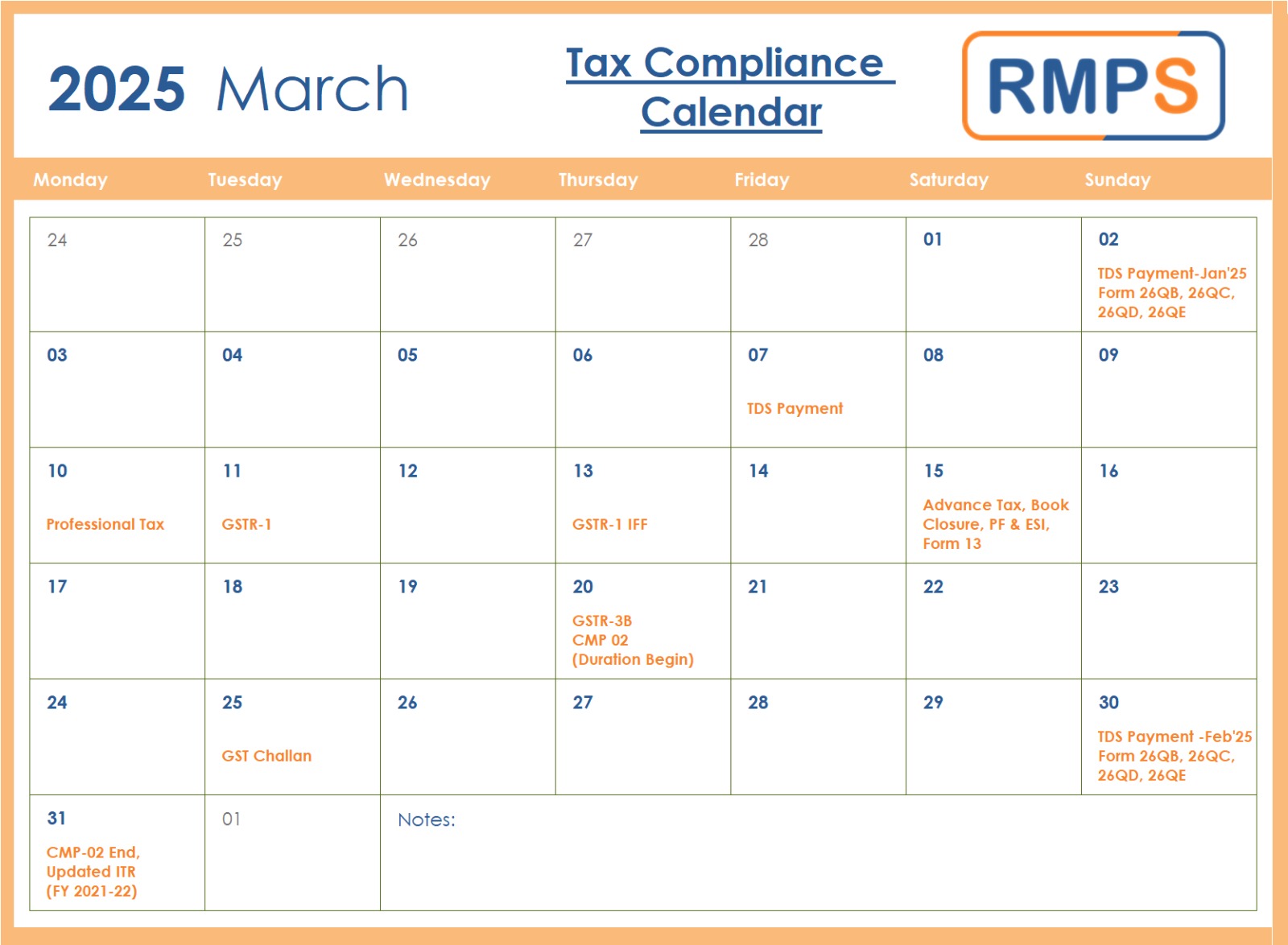

March 2025 Tax Compliance Calendar: Key Deadlines & Due Dates

March is a crucial month for tax compliance, with several key deadlines for businesses and individuals. Staying on top of these due dates helps avoid penalties and ensures smooth financial operations. Below is a structured compliance calendar for March 2025. Key Tax Deadlines for March 2025 Early March Compliance Mid-March Compliance Late March Compliance Why […]

GST Rates Clarifications as per Circular No. 247/04/2025-GST

The Ministry of Finance, Department of Revenue (Tax Research Unit) has issued Circular No. 247/04/2025-GST, dated 14th February 2025, to clarify GST Rates and product classifications. These updates stem from the 55th GST Council Meeting held on 21st December 2024 in Jaisalmer. The goal is to ensure consistent tax implementation across different regions. Below are […]

GST in E-Commerce: Impacts, Advantages, and Challenges

Introduction The Goods and Services Tax (GST) has revolutionized India’s tax landscape since its introduction on July 1, 2017. Designed to streamline taxation, reduce cascading taxes, and promote transparency, GST has played a pivotal role in shaping the e-commerce sector. While GST has simplified tax compliance for many industries, e-commerce sellers face unique challenges due […]

Builders & Promoters: GST Rules for RCM and 80% Purchase Compliance

Builders & Promoters must follow Reverse Charge Mechanism (RCM) rules when purchasing goods and services. To qualify for a lower 1% or 5% tax rate, they must buy at least 80% of input goods and services from registered dealers. If they fail to meet this rule, they must pay 18% GST under RCM on the […]

GST on Export of Services: A Complete Guide to Refunds and Compliance

GST on Export of Services offers several advantages, yet businesses must navigate tax compliance requirements carefully. This guide simplifies the GST framework for exporting services, covering refunds, compliance, and essential documentation to ensure a smooth process. Table of Contents Understanding GST on Export of Services Under GST, the export of services is classified as a […]

Form ENR-03: E-Way Bill Enrolment for Unregistered Dealers

The E-Way Bill (EWB) system has introduced a new feature that simplifies compliance for unregistered dealers engaged in goods transportation. Starting February 11, 2025, businesses without GST registration can enrol using Form ENR-03 to obtain a unique Enrolment ID. Consequently, they can now generate e-Way Bills effortlessly without requiring a GSTIN. This update, introduced through […]

GST Registration Process: Key Guidelines for Taxpayers

Introduction With recent changes in the GST Registration process, taxpayers must follow updated procedures to ensure a smooth experience. Rule 8 of the CGST Rules, 2017 outlines specific steps based on Aadhaar authentication preferences. Below is a simplified guide to help you complete your registration without delays. 1. Steps for Applicants Not Opting for Aadhaar […]