GST Update: Taxability of Vouchers & Department Appeals – Key Clarifications

Introduction The Central Board of Indirect Taxes and Customs (CBIC) has issued Instruction No. 02/2025-GST on February 7, 2025. This instruction clarifies the procedure for department appeals involving interest and penalty disputes under Section 128A of the CGST Act, 2017. Many businesses face challenges when tax amounts are fully paid, but disputes over interest or […]

Decoding Budget 2025 All-in-One Insights on GST Changes

The Union Budget 2025, presented on February 1, 2025, introduces significant GST amendments. These changes aim to streamline compliance, simplify tax procedures, and enhance trade efficiency. Below is a breakdown of the most critical updates. 1. Key Changes in GST Definitions a) Input Service Distributors (ISD) – ITC Distribution for RCM on Inter-State Supplies 📢 […]

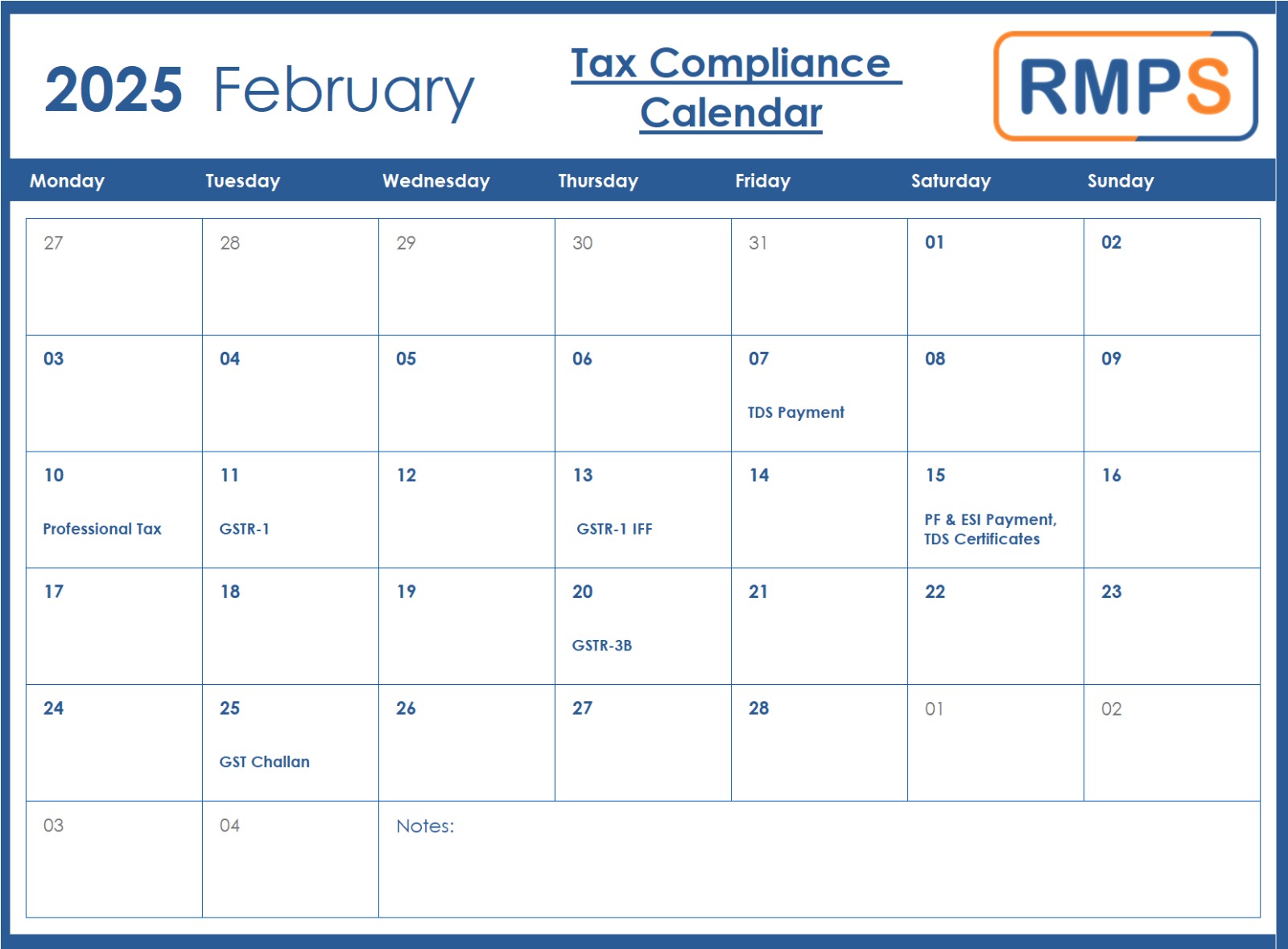

Key Tax Compliance Deadlines for February 2025: A Simple Guide

Tax compliance is essential for smooth business operations. Missing deadlines can lead to penalties, interest charges, and unnecessary hassles. By staying informed and planning ahead, businesses can avoid financial burdens and ensure compliance. Below are the critical tax deadlines for February 2025. Important Tax Deadlines – February 2025 7th February – TDS Payment for January […]

Viksit Bharat 2047: How Budget 2025-26 Aligns with India’s Growth Vision

Dear Readers, India’s economic landscape is at an inflection point, driven by strategic reforms, resilient growth, and an ambitious vision for “Viksit Bharat 2047.” As the nation moves toward becoming a developed economy by 2047, the Economic Survey 2024-25 and the Union Budget 2025-26 provide a roadmap for sustainable, inclusive, and innovation-led growth, catering to […]

TDS & TCS Rates for FY 2025-26 Key Budget Updates You Need to Know

1. Rationalization of TDS Rates and Thresholds (A) Reduction in TDS Rates for Section 194LBC (B) Increase in TDS Thresholds for Various Payments In addition to the changes to TDS/TCS rates, the budget proposals also aim to rationalize various TDS provisions by adjusting the thresholds beyond which tax must be deducted. Below is the detailed […]

2025 Customs Duty Update: Key Increases, Decreases, and Their Impact on Various Sectors

The Customs Tariff Act, 1975 is undergoing significant changes in its duty rate schedule. With the Finance Bill, 2025 introducing amendments that will come into effect from February and May 2025, businesses across various sectors must understand how these changes affect import and export duties. In this post, we break down the amendments sector‑wise, covering […]

Real Estate Sector – GST Updates from July 2024 to January 2025

From July 2024 to January 2025, significant changes in the Goods and Services Tax (GST) system have impacted the real estate sector. These updates affect various aspects of taxation, including preferential location charges (PLC), reverse charge mechanisms (RCM), and the treatment of immovable property. It is essential for builders, developers, and property buyers to stay […]

GST Return Filing – JULY 2024 to January 25 GST UPDATES

Introduction to GST Return Filing Updates From July 2024 to January 2025, significant updates have impacted the GST return filing process. These updates focus on new deadlines, amended forms, and added features that simplify the filing process. Businesses need to be aware of these changes to stay compliant and avoid penalties. Key Changes in GST […]

GST Recent Amendments – July 2024 to January 2025 Updates

Introduction: Staying updated with GST changes is essential for businesses. The amendments introduced between July 2024 and January 2025 bring significant updates. These modifications impact compliance procedures, tax rates, and industry-specific regulations. By understanding these changes, businesses can remain compliant and avoid penalties. Key Changes and Updates Sr. No Blogs 1 New ISD Registration Requirement […]

GST ITC – Key Updates from July 2024 to January 2025

GST compliance has changed significantly in recent months. The introduction of the Invoice Management System (IMS), revised ITC rules, and improved transparency tools are key updates. These changes simplify tax reporting, reduce mismatches, and enhance accuracy. Sr. No Blogs 1 RCM Liability/ITC Statement: A New Transparency Tool on the GST Portal 2 Understanding the Invoice […]