Understanding TDS Under GST: A Comprehensive Guide for Payments Over ₹2.5 Lakh

Understanding TDS under GST

Ensuring Your Ledger Balance Matches with the Books: A GST Compliance Guide

Keeping the ledger balance in sync with your books of accounts is a fundamental step to maintain GST compliance and avoid any penalties or audits. Here’s a structured process to ensure that your ledger and books reflect accurate financial data, helping you stay on top of your GST filings. 1. Monthly Reconciliation of Ledger and […]

Archival of GST Returns Data on GST Portal: What You Need to Know

Keeping up with tax updates is essential for every taxpayer. A new data archival policy on the GST portal could affect how long you can access your past GST returns. Let’s break down the key points and what actions you need to take. Key Update: Section 39(11) of the CGST Act, 2017 From October 1, […]

Invoice Management System (IMS): A Comprehensive Update

With the launch of the Invoice Management System (IMS), the GST landscape is set for a major upgrade. Effective from October 1, 2024, IMS empowers taxpayers to manage invoices more efficiently, allowing you to accept, reject, or keep invoices pending. This blog dives deep into the functionalities of IMS, covering frequently asked questions (FAQs) and […]

Understanding GST on Rent After the 54th GST Council Meeting: Key Updates and Changes

The 54th GST Council Meeting introduced several important updates regarding GST on rent for both commercial and residential properties. These changes impact both landlords and tenants based on their GST registration status. Let’s explore these updates clearly and concisely. Commercial Property: GST Rules Explained 1. Both Landlord and Tenant Registered When both the landlord and […]

Revolutionizing GST Compliance: The New Invoice Management System (IMS)

In a major leap for the GST ecosystem, the GST Common Portal has launched the Invoice Management System (IMS). This system transforms how recipient taxpayers handle invoices. Now, taxpayers can easily accept, reject, or keep invoices pending for future use. As a result, the process becomes more streamlined, improving reconciliation and boosting accuracy. Key Features […]

Understanding Advance Tax: A Comprehensive Guide

Advance tax is an essential part of income tax management in India. It allows taxpayers to spread their tax payments throughout the financial year rather than making a large payment at the end. This guide will explain what advance tax is, who needs to pay it, important due dates, and how you can pay it […]

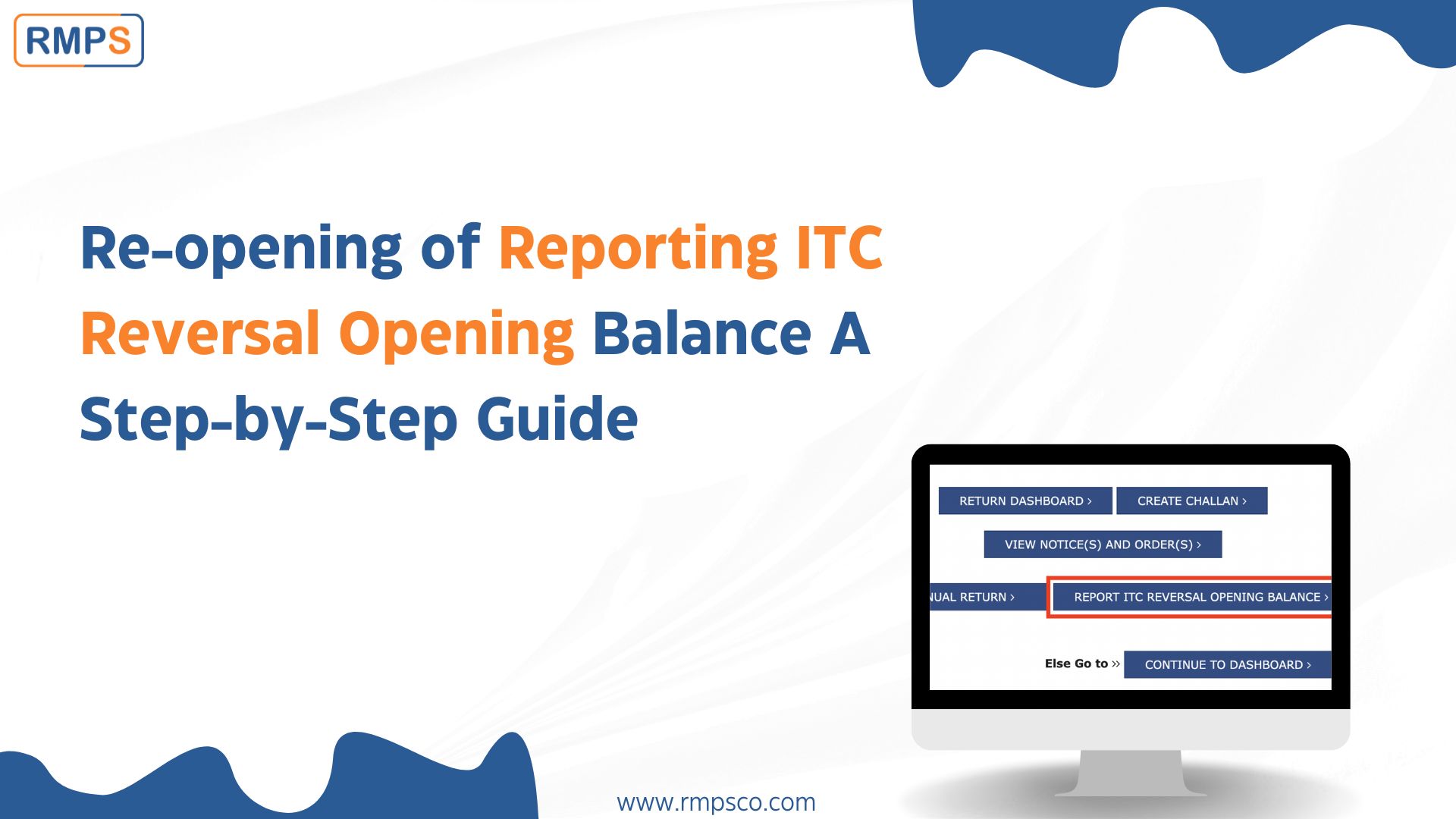

Re-opening of Reporting ITC Reversal Opening Balance: A Step-by-Step Guide

The government has re-opened the reporting of ITC (Input Tax Credit) reversals. Businesses need to follow new steps to comply with this update. In this blog, we’ll explain the changes and how you can report your ITC reversal correctly. What Has Changed? In July 2022, the government introduced Notification No. 14/2022 – Central Tax. This […]

Updates on Circular No. 233/27/2024-GST: Clarification on IGST Refunds for Exporters

The Central Board of Indirect Taxes and Customs (CBIC) issued Circular No. 233/27/2024-GST on 10th September 2024. This circular clarifies the rules on IGST refunds for exporters who previously availed tax exemptions on imported inputs. Key Points: Rule 96(10) of CGST Rules, 2017: Amendment to Rule 96: This update helps exporters regularize their payments and […]

Income Tax Act, 1961 vs. Direct Tax Code, 2025: What’s Changed and Why It Matters

India is preparing for a significant shift in its tax landscape with the introduction of the Direct Tax Code (DTC) 2025. Back in 2017, the Ministry of Finance formed a task force to draft a new direct tax law. The goal of this law is to simplify tax regulations, expand the tax base, and make […]