Navigating GST Refunds for E-Commerce Businesses: A Comprehensive Guide

Introduction: In the dynamic world of e-commerce, where transactions happen at the click of a button, understanding the nuances of Goods and Services Tax (GST) refunds is crucial for businesses to optimize their financial operations. GST refunds play a significant role in ensuring that businesses can recover the taxes they paid on inputs, thereby preventing […]

India’s Interim Budget 2024-2025: Unveiling a Vision of “Transforming Dreams into Reality”

It is with immense excitement and optimism that I introduce you to a transformative document that encapsulates the spirit of progress and aspiration—India’s Interim Budget for the fiscal year 2024-2025. Under the resounding theme of “Transforming Dreams into Reality”, this budget stands as a symbol of our nation’s unwavering commitment to turning aspirations into tangible […]

Navigating the Tax Maze: Your Ultimate Guide to GST Insights (Feb 2023 – Jan 2024)

Description: Dive into the dynamic world of Goods and Services Tax (GST) with our comprehensive blog series. From the latest regulatory updates to expert insights on compliance, our curated collection of articles covers everything you need to know about GST. Stay informed, make strategic decisions, and empower your business with the knowledge to navigate the […]

Key GST Case Laws (Feb 2023 – Jan 2024): Navigating Legal Precedents in Taxation

Explore the dynamic landscape of Goods and Services Tax (GST) through our curated compilation of the “Top 24 Case Laws” spanning from February 2023 to January 2024. This comprehensive collection delves into pivotal legal precedents, providing valuable insights into the evolving nuances of GST regulations. From landmark decisions to nuanced interpretations, these case laws offer […]

Complying with the Law: Mandatory Bank Account Details Submission for GST Registered Taxpayers

Introduction: Ensuring compliance with the Central Goods and Services Tax (CGST) Act, 2017, is paramount for businesses operating within the GST framework. One critical aspect of this compliance is the mandatory submission of bank account details by registered taxpayers. In this blog post, we will explore the legal provisions requiring this submission, the consequences of […]

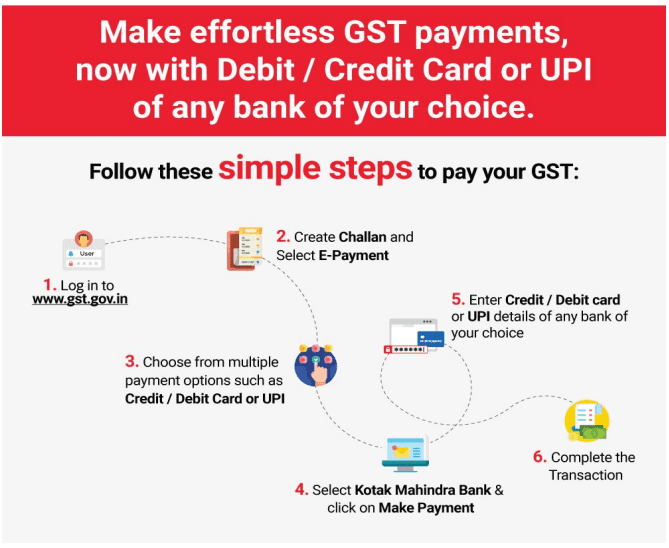

Expanding Horizons: New Payment Options for GST Taxpayers

Introduction: In a move to enhance convenience for taxpayers registered under the Goods and Services Tax (GST), the government has introduced two additional methods of payment under the e-payment system. These new facilities, namely Credit Card (CC) and Debit Card (DC), along with Unified Payments Interface (UPI), offer taxpayers more flexibility in managing their financial […]

“Simplified Steps: Understanding GSTR-1/IFF’s Tables 14 and 15”

Introduction: The ever-evolving landscape of Goods and Services Tax (GST) in India has brought forth a new advisory – Notification No.: 26/2022 – Central Tax dated December 26, 2022. This advisory sheds light on the introduction of Tables 14 and 15 in the GSTR-1/IFF (Invoice Furnishing Facility), impacting businesses involved in E-Commerce transactions or liable […]

GST Portal Unveils Unified Interface for Notices and Orders Tab.

The Goods and Services Tax (GST) Portal introduces a user-friendly redesign, consolidating “Notice and Order” and “Additional Notices and Orders” tabs into a single window. This unified interface enhances efficiency and simplifies access for users. It offers a comprehensive view of diverse tax-related communications, including registration, return defaults, and assessment orders. Notably, the Refund module […]

Navigating the Financial Year End: Essential Checkpoints for GST and Accounting Compliance

Introduction: As the financial year draws to a close, businesses must gear up for the annual ritual of evaluating their financial health, ensuring compliance with tax regulations, and preparing for the upcoming year. In this blog post, we will explore the crucial checkpoints that businesses need to consider for Goods and Services Tax (GST) compliance […]

Breaking News: Decision Of Blocking Generation Of E-Way Bill Without GST E-Invoice Withdrawn.

Introduction: Hey, fellow business enthusiasts! 🌐✨ We’ve got some exciting news to share in the world of electronic invoicing. Brace yourselves for a game-changing update – the blockage of E-Way Bill generation without e-InvoiceIRN has officially been lifted! 🎉💼 Why the Change? on analysis, it is found that some of the taxpayers, who are eligible […]