Claiming Refund for Excess Payment of Tax under GST – A Step-by-Step Guide

Overpaid GST due to an error? You’re not alone. Many businesses accidentally pay GST twice or enter the wrong tax head. Fortunately, the GST system allows you to request a refund for any excess payment of tax using Form RFD-01. Let’s break down the process into clear steps, so you can claim your refund without […]

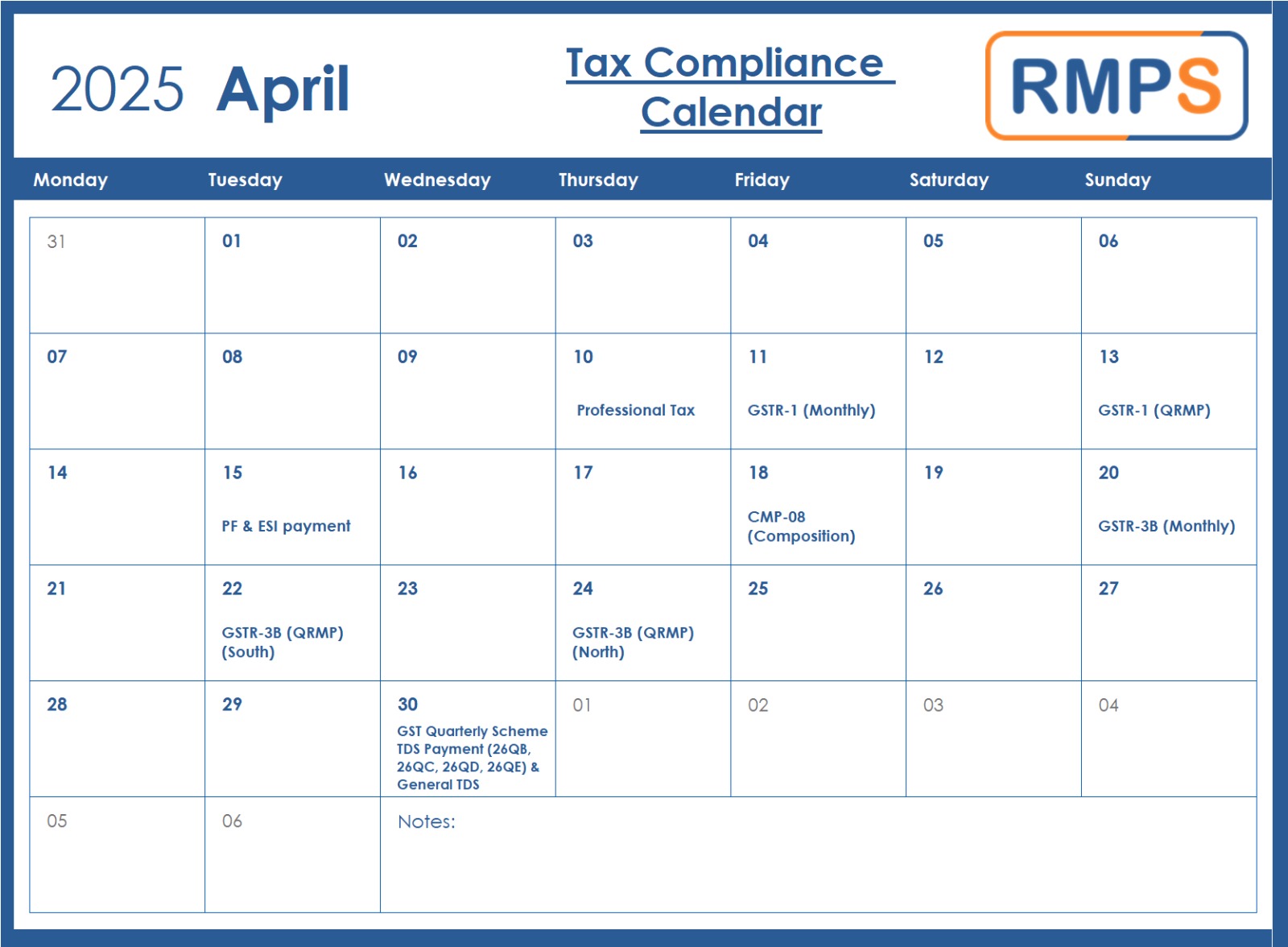

Key GST Updates for April 2025: Changes in GSTR-1, GSTR-1A & GSTR-3B You Must Know

The Goods and Services Tax Network (GSTN) has introduced important updates that will apply from the April 2025 tax period. These GST updates focus on changes in Table-12 of GSTR-1/GSTR-1A and Table 3.2 of GSTR-3B. Businesses must understand these changes to file returns correctly and avoid compliance issues. Let’s take a closer look at the […]

GST on Real Estate in India: A Simplified Overview for Homebuyers and Developers

The implementation of the Goods and Services Tax (GST) brought significant changes across industries in India, and the real estate sector is no exception. Understanding the GST implications on residential properties is vital for both developers and homebuyers. This blog simplifies the GST framework on real estate, its historical evolution, and its impact on property […]

GST Waiver Applications: Common Challenges and Solutions

Filing waiver applications (SPL 01/SPL 02) under the GST waiver scheme has presented several challenges for taxpayers. The Goods and Services Tax Network (GSTN) has acknowledged these issues and is working towards resolving them. Meanwhile, understanding the problems and available solutions can help taxpayers navigate the process smoothly. Challenges Faced While Filing GST Waiver Applications […]

How to Track Your GST Refund Application Status on the GST and PFMS Portals

Introduction For businesses and taxpayers, tracking GST refund applications is crucial to ensure timely processing and disbursal of funds. The Goods and Services Tax (GST) portal and the Public Financial Management System (PFMS) portal provide mechanisms to monitor the progress of refund applications. This guide will help you navigate both platforms efficiently. Understanding the GST […]

Delhi High Court’s Landmark Ruling: Clerical Errors in GST Invoices Can’t Deny ITC Claims

Introduction On March 12, 2025, the Delhi High Court delivered a crucial ruling in the case of M/S B Braun Medical India Pvt Ltd v. Union of India & Ors. The judgment addressed the rejection of Input Tax Credit (ITC) due to a clerical error in the supplier’s invoices. The invoices incorrectly mentioned the GSTN […]

Understanding GST on Google and Facebook Advertisements in India

In today’s digital marketing landscape, businesses frequently use platforms like Google and Facebook for advertising to reach their target audience. However, while planning online ad expenditures, it is crucial to understand the Goods and Services Tax (GST) implications on Google and Facebook transactions. This article provides a detailed breakdown of how GST applies to advertisements […]

Job Work Under GST: Compliance, Documentation & Input Tax Credit

Introduction Job work plays a crucial role in the Indian manufacturing and processing industries. Under the Goods and Services Tax (GST) regime, job work refers to a process where one party performs specific treatments or modifications on goods owned by another registered business. This ensures operational flexibility while maintaining compliance with GST regulations. This blog […]

The Delhi High Court’s Verdict on GST Registration Cancellation: A Landmark Decision

Introduction In a significant ruling, the Delhi High Court set aside the retrospective cancellation of GST registration for JSD Traders LLP. The case, W.P.(C) 2608/2025, challenged the arbitrary cancellation of GST registration dating back to 2017. It raised crucial questions about procedural fairness and legal compliance under the Central Goods and Services Tax Act, 2017 […]