GST must be paid by the publisher if the payment is made to the legal heirs of the author, or when the recipient of the royalty is a university, a corporate entity (domestic or foreign), or a trust.

This article will explore the nuances and legal provisions involved, particularly in the context of the Central Goods and Services Tax (CGST) Act, 2017. Additionally, it will examine the relevant notifications issued by the Central Board of Indirect Taxes and Customs (CBIC).

Reverse Charge Mechanism (RCM) Explained

The term “reverse charge” refers to the liability to pay tax by the recipient of goods or services, rather than the supplier. This concept is defined under Section 2(98) of the CGST Act, 2017. Moreover, the CGST Act, specifically under Section 9(3), Allows the government. And upon the recommendation of the GST Council, to notify categories of goods or services where the tax is payable by the recipient.

Notification No. 13/2017 – Central Tax (Rate)

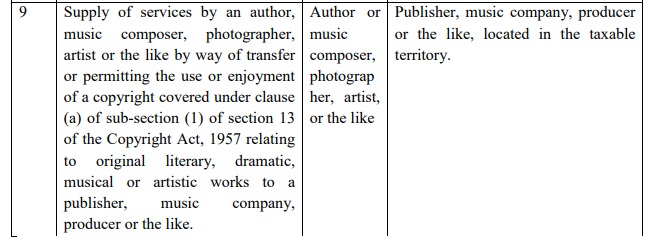

On June 28, 2017, the CBIC issued Notification No. 13/2017, which specifies various categories of services on which GST must be paid by the recipient under the RCM.

This includes the supply of services by way of transferring or permitting the use or enjoyment of a copyright relating to original literary, dramatic, musical, or artistic works to a publisher.

Applicability of GST on Royalty Payments to Authors

According to the provisions mentioned in Notification No. 13/2017. When an author provides services by way of allowing the use of their copyright to a publisher. GST is payable by the publisher under the RCM.

Essential Points:

- Liability to pay GST under the RCM depends on the type of service, not the recipient of the payment.

- The publisher is responsible for GST if the service is listed under Notification No. 13/2017.

Compliance:

- Publishers must understand and comply with these provisions to avoid tax issues.

- Ensures correct fulfilment of tax obligations.

Implications for Different Recipients of Royalty Payments

1.Payments to legal heirs:

If the payment is made to the legal heirs of the author, the publisher is still liable to pay GST under the RCM. This is because the essence of the provision is based on the type of service provided, not the recipient of the payment.

2.Payments to universities or corporate entities:

If the royalty is paid to a university, a corporate entity, or a trust, whether domestic or foreign, the GST liability under the RCM does not shift. Consequently, the publisher remains responsible for paying the tax.

Conclusion

The applicability of GST under the RCM for royalty payments made by publishers to authors (or their legal representatives) is governed under the specified list in Notification No. 13/2017. Therefore, understanding these provisions is crucial for compliance and avoiding potential tax issues.

LinkedIn Link : RMPS Profile

This article is only a knowledge-sharing initiative and is based on the Relevant Provisions as applicable and as per the information existing at the time of the preparation. In no event, RMPS & Co. or the Author or any other persons be liable for any direct and indirect result from this Article or any inadvertent omission of the provisions, update, etc if any.

Published on: May 17, 2024